Tomorrow is Going to be a Really Bad Day

Tomorrow is Going to be a Really Bad Day

Human beings in general (and entrepreneurs especially), are an optimistic

lot. Our unshakable belief in our ability to overcome challenges gives us

strength. Confidence that life/business will keep getting better and better

drives us forward to success. We don't much dwell upon remote worst case

scenarios.

Business owner or not, most people have the mindset that, "Tomorrow's going

to be a whole lot like today." We'll get up in the morning, go through our

start-the-day routine, head to the office and make things happen: work on

projects, close a deal, help a client, build a relationship, finish a

report, etc. And so it goes the next day. Rinse and repeat.

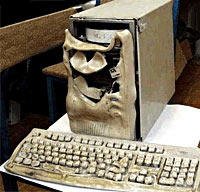

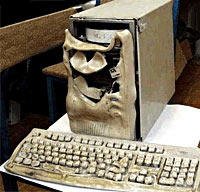

But sh*t happens. A hard disk crashes, the phone system goes down, a monster

storm approaches, the power grid fails, the roof leaks, a fire starts, a

plane hits the building…

Suddenly business as usual turns into no business at all

According to FEMA (the Federal Emergency Management Agency), 40% of small

businesses never reopen if a disaster shuts down operations even for a short

time. According to FEMA (the Federal Emergency Management Agency), 40% of small

businesses never reopen if a disaster shuts down operations even for a short

time.

In my work with successful company owners, I often design business

continuity plans -- but from a special perspective: making sure the business

can continue if the owner does not. Equipment meltdowns, natural disasters,

fires and floods, violent attacks -- all are horrible events. But the

business can survive them. However, few businesses can survive the death or

permanent disability of an owner. So, even though my professional focus is

contingency planning for solely owned and partner owned businesses, we can't

neglect more broad-based disaster planning. It's appropriate for EVERY

business, from solo home-based to the largest multi-national corporation.

I'll give you a few Do-It-Yourself tips in this article but the best advice

I can offer is to seek out a special person to help you. You see, there is a

certain breed-of-cat-individual who's wired a bit differently than you and

me. This man or woman thinks constantly about the thousands of ways things

can go wrong. These TGRBD (Tomorrow is Going to be a Really Bad Day) folks

are known as P&C Brokers. Think of them

like your car or homeowner insurance agent on steroids. (There are also

consultants who specialize in this area.) Good ones will take the time to

learn all the ins and outs of your company operation, perform a

comprehensive risk analysis, and offer the right strategies and insurance

products to control those risks.

While that's my number one recommendation: take the time to find a really

great P&C insurance broker or consultant, I also promised you some DIY tips

too. Here goes:

Tip #1: Create a Disaster Plan

The more elaborate the better. Brainstorm as many worst case scenarios as

possible and think about possible work-arounds. This is a great group

activity. The more smart people you get in a room at one time to do this,

the better the results. At a minimum, you must consider what you'd do if

forced to suddenly relocate operations due to a fire or other disaster.

Where will you set up shop? How? Who will go there? How will you

communicate? Et cetera. What if your business is very dependent upon a

single key supplier? How could that supply chain be disrupted? (See photo

above.) What's your

Plan B? Plan C? A comprehensive disaster plan can run to hundreds of pages

but even a very short one is MUCH better than nothing.

Tip #2: Put Somebody in Charge

Somebody needs to be the point person, ready to swing into action in case of

a disaster. Could be you, could be a key employee, but that person must be

tasked with communication and coordination in a time of crisis. Hopefully,

that person has the ability to update a web site with information that

employees, vendors, and customers can access. When choosing your point

person, you of course want somebody who'll keep their cool when everything

is falling apart. However, don't base that decision based solely upon how

they react to the small everyday disasters (Blue Screen of Death on the

computer for example). People are like tea bags -- you don't know their

strength until they're in hot water. At the risk of gender-generalizing,

it's been my experience that women tend to get unnecessarily upset over the

"small stuff" but do better than us guys when things go really, really bad.

There's more to this. Your emergency point person should also monitor your

disaster preparedness on an ongoing basis, conduct evacuation drills, make

sure your first aid kit is stocked, the flashlights work, there's bottled

water available, the exits aren't blocked, et cetera, et cetera. Somebody

has to worry about all this, and (in general), I find that moms are just

better worriers than us dads.

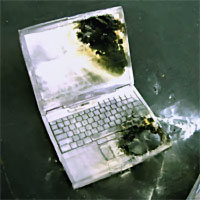

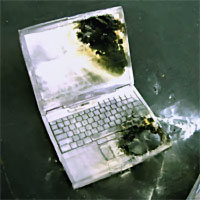

Tip #3: Save the Data! Save the Data!

The files on your hard disk. The paper records, invoices, legal documents,

proposals, and so forth. Your archived CD's and tapes. All are data and all

can be irretrievably lost in an instant. Ask those folks who made it out of

the twin towers with their lives but without their data. Many of those

companies folded. They couldn't recreate what was lost fast enough to

continue their businesses. Some couldn't even get insurance reimbursement

without adequate proof of loss. It goes without saying that you MUST have a

back up system for ALL your computers. I'm still astounded by the number of

small businesses that don't. You must have redundant backup, with off-site

storage of media. Pay somebody to figure this stuff out if you don't know

how. Today! Consider starting a program to scan-in all important paper

documents so they can be properly backed up too. You'll want (at a minimum)

to scan/archive your tax returns, payroll records, accounting statements,

legal docs, customer lists, supplier lists, contracts, and contact info for

all employees (including cell phone numbers, home addresses, next of kin,

etc.). For small or home-based businesses, consider an online backup service

like www.mozy.com. The MozyPro service costs $3.95 a month plus fifty cents

per gigabyte of backed up data storage. The MozyHome service costs just

$4.95 a month for unlimited backup. The files on your hard disk. The paper records, invoices, legal documents,

proposals, and so forth. Your archived CD's and tapes. All are data and all

can be irretrievably lost in an instant. Ask those folks who made it out of

the twin towers with their lives but without their data. Many of those

companies folded. They couldn't recreate what was lost fast enough to

continue their businesses. Some couldn't even get insurance reimbursement

without adequate proof of loss. It goes without saying that you MUST have a

back up system for ALL your computers. I'm still astounded by the number of

small businesses that don't. You must have redundant backup, with off-site

storage of media. Pay somebody to figure this stuff out if you don't know

how. Today! Consider starting a program to scan-in all important paper

documents so they can be properly backed up too. You'll want (at a minimum)

to scan/archive your tax returns, payroll records, accounting statements,

legal docs, customer lists, supplier lists, contracts, and contact info for

all employees (including cell phone numbers, home addresses, next of kin,

etc.). For small or home-based businesses, consider an online backup service

like www.mozy.com. The MozyPro service costs $3.95 a month plus fifty cents

per gigabyte of backed up data storage. The MozyHome service costs just

$4.95 a month for unlimited backup.

Tip #4: Insure Your Future

Talk to your broker about a special "business interruption" policy or rider.

This coverage can make up for lost income if you're forced to shut your

doors after a fire or other covered event. Business interruption insurance

is a highly customized product, so you want to work with a professional to

first understand your true risk exposures and then design coverage that'll

address the risks you can't self-insure. Covering every possible worst case

scenario will be very expensive. That's why you should take to heart all the

other disaster planning stuff I'm talking about in this article. Regardless,

you'll want to document not only your major business assets, but record

everything you might need to replace. A digital camera and/or video

camcorder will come in very handy for this. Also, be sure to create digital

scans of purchase receipts/contracts and archive them along with your other

critical data.

Tip #5: The War Chest

Cash is the lifeblood of a business. If a disaster drains that blood, your

business will die. That's why you need to keep AT LEAST ninety days worth of

operating cash in your war chest. It may take that long for you to get back

on your feet or to receive insurance money. If you can't or won't tie up

that much cash in the bank, your Plan B might be to establish a special

business line of credit you can draw upon for extraordinary working capital. Cash is the lifeblood of a business. If a disaster drains that blood, your

business will die. That's why you need to keep AT LEAST ninety days worth of

operating cash in your war chest. It may take that long for you to get back

on your feet or to receive insurance money. If you can't or won't tie up

that much cash in the bank, your Plan B might be to establish a special

business line of credit you can draw upon for extraordinary working capital.

Tip #6: Know that Bad Things Happens to Good People

The worst kind of business disaster might be one that doesn't destroy data,

burn down the building, disable the supply chain, or prevent employees from

communicating. The worst case scenario might well be a sudden heart attack,

stroke, or car accident that kills or permanently disables the owner. Even

for large companies, the business often dies shortly after the owner does.

(Particularly when that owner is a "key employee," a rainmaker, keeper of

the secret sauce formula, maintainer of customer/vendor relationships, or

provider of a critical skillset.) Entrepreneurs frequently maintain

substantial personal loan guarantees, or otherwise personally ensure the

financial health of the company. As I mentioned at the beginning of this

article, one area I specialize in is the development of business continuity

strategies that make sure the business can survive the death/disability of

an owner (or survive disputes between partners, which can be equally fatal).

The Good News

Did all this doom and gloom talk bring you down? Sorry. It's a subject

too important to ignore. The good news is that once you've got your disaster

and business continuity plan in place, you can return to thinking about

growing the business asset that needs protecting in the first place.

|

Tomorrow is Going to be a Really Bad Day

Tomorrow is Going to be a Really Bad Day

According to FEMA (the Federal Emergency Management Agency), 40% of small

businesses never reopen if a disaster shuts down operations even for a short

time.

According to FEMA (the Federal Emergency Management Agency), 40% of small

businesses never reopen if a disaster shuts down operations even for a short

time.

The files on your hard disk. The paper records, invoices, legal documents,

proposals, and so forth. Your archived CD's and tapes. All are data and all

can be irretrievably lost in an instant. Ask those folks who made it out of

the twin towers with their lives but without their data. Many of those

companies folded. They couldn't recreate what was lost fast enough to

continue their businesses. Some couldn't even get insurance reimbursement

without adequate proof of loss. It goes without saying that you MUST have a

back up system for ALL your computers. I'm still astounded by the number of

small businesses that don't. You must have redundant backup, with off-site

storage of media. Pay somebody to figure this stuff out if you don't know

how. Today! Consider starting a program to scan-in all important paper

documents so they can be properly backed up too. You'll want (at a minimum)

to scan/archive your tax returns, payroll records, accounting statements,

legal docs, customer lists, supplier lists, contracts, and contact info for

all employees (including cell phone numbers, home addresses, next of kin,

etc.). For small or home-based businesses, consider an online backup service

like

The files on your hard disk. The paper records, invoices, legal documents,

proposals, and so forth. Your archived CD's and tapes. All are data and all

can be irretrievably lost in an instant. Ask those folks who made it out of

the twin towers with their lives but without their data. Many of those

companies folded. They couldn't recreate what was lost fast enough to

continue their businesses. Some couldn't even get insurance reimbursement

without adequate proof of loss. It goes without saying that you MUST have a

back up system for ALL your computers. I'm still astounded by the number of

small businesses that don't. You must have redundant backup, with off-site

storage of media. Pay somebody to figure this stuff out if you don't know

how. Today! Consider starting a program to scan-in all important paper

documents so they can be properly backed up too. You'll want (at a minimum)

to scan/archive your tax returns, payroll records, accounting statements,

legal docs, customer lists, supplier lists, contracts, and contact info for

all employees (including cell phone numbers, home addresses, next of kin,

etc.). For small or home-based businesses, consider an online backup service

like  Cash is the lifeblood of a business. If a disaster drains that blood, your

business will die. That's why you need to keep AT LEAST ninety days worth of

operating cash in your war chest. It may take that long for you to get back

on your feet or to receive insurance money. If you can't or won't tie up

that much cash in the bank, your Plan B might be to establish a special

business line of credit you can draw upon for extraordinary working capital.

Cash is the lifeblood of a business. If a disaster drains that blood, your

business will die. That's why you need to keep AT LEAST ninety days worth of

operating cash in your war chest. It may take that long for you to get back

on your feet or to receive insurance money. If you can't or won't tie up

that much cash in the bank, your Plan B might be to establish a special

business line of credit you can draw upon for extraordinary working capital.